💵Tax System

The Tax system is the most crucial system that enables Landowners to share in the growth of JEFFWorld. JEFFWorld's Land is more than just a virtual real estate; it allows Landowners to own, enjoy, lease, and activate their land to increase rewards. It is a unique metaverse content where Landowners can actively participate and benefit from the growth of JEFFWorld.

Where is Tax collected?

Tax is based on activities within the core contents of JEFFWorld, specifically 1) City-Grooming and 2) Community Zone. The more users engage with these contents, the higher the Tax that goes back to the Landowners.

City-Grooming: When users sell (convert to $JEFF) the rewards they receive after City-Grooming, such as Crystals, a 5% Tax is collected.

CONNECT.Zone: 5% of the advertising revenue generated through the exterior billboards in the CONNECT.Zone is collected as Tax. (The CONNECT.Zone Tax Pool is collected after the introduction of Phase V2 Land DAO.)

Phases

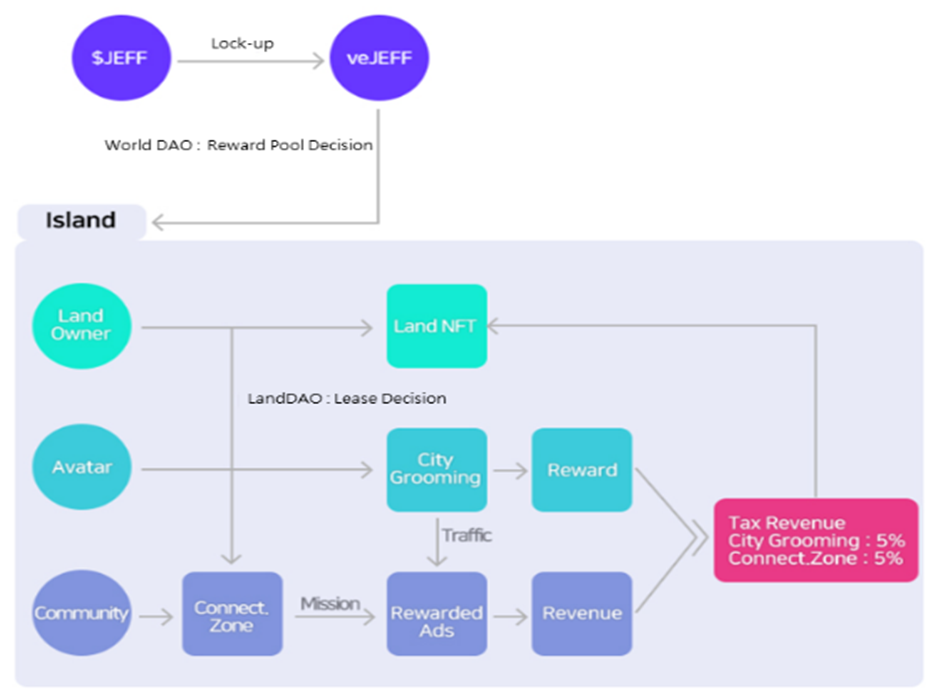

Tax differentiation by each Island is carried out in phases. The Rewards Pool allocated to each Island starts to vary through the World DAO system. Additionally, Landowners can personally select and decide on the leasing of Community Zones in each Island through the Land DAO system.

V1: Initially, the distribution of Rewards Pool among Islands is distributed equally based on the number of Lands.

V2: With the introduction of the DAO system, veJEFF holders and Landowners actively participate in Jeff World.

World DAO: Determines the distribution of $JEFF rewards for each Island, aiming to increase user participation in City-Grooming.

Land DAO: Determines the leasing conditions and prices of Community Zones, where Community Power equals advertising revenue.

Tax Claims

Tax claims are conducted in predefined cycles and vary based on the Land Grade and the number of Lands in each Island.

Land Point(LP): Grade 1 = 1P / Grade 2 = 2P / Grade 3 = 4P

Total Land Point(TLP): The sum of Land NFT Points in a specific Island.

Tax Pool(TP): The total amount of Tax ($JEFF) collected in a specific Island.

Claimable Tax Rewards: The total amount of Tax that can be claimed based on LP for each holder.

ex) Holder in the Smeade region owns 1 Grade 1 LAND and 2 Grade 3 Lands.

Smeade Sum(HolderLP) = 9P, Smeade TLP = 2,050P, Smeade TP = 300,000 $JEFF(예시)

Claimable Tax Rewards = 300,000 * [9P / 2,050P] = 1,317 $JEFF

Active Local Marketing

To receive more Tax, actively promote the Island where your Land is located. You can directly operate a COM.Store or attract it, and you can also attract places with significant community power. All efforts will be rewarded with Tax. Yes In My Back Yard!

Competitive Entry

If an Island has high traffic, there may be competition for new communities or brands to enter. More traffic means more revenue for the community. Certain communities may also reward Landowner or offer physical benefits to entry. Also, the community itself can exercise World DAO voting rights to increase the token Rewards Pool distributed to the Island.

Last updated